Furninova by Satariano

An impactful digital campaign that captures the essence of Scandinavian comfort and craftsmanship, elevating Furninova’s presence in the Maltese market.

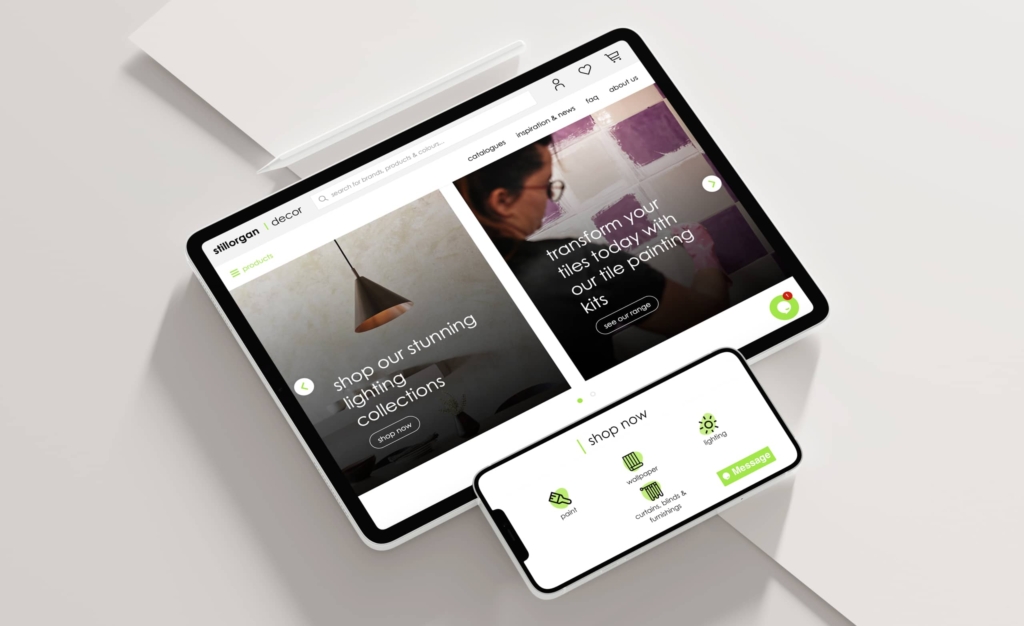

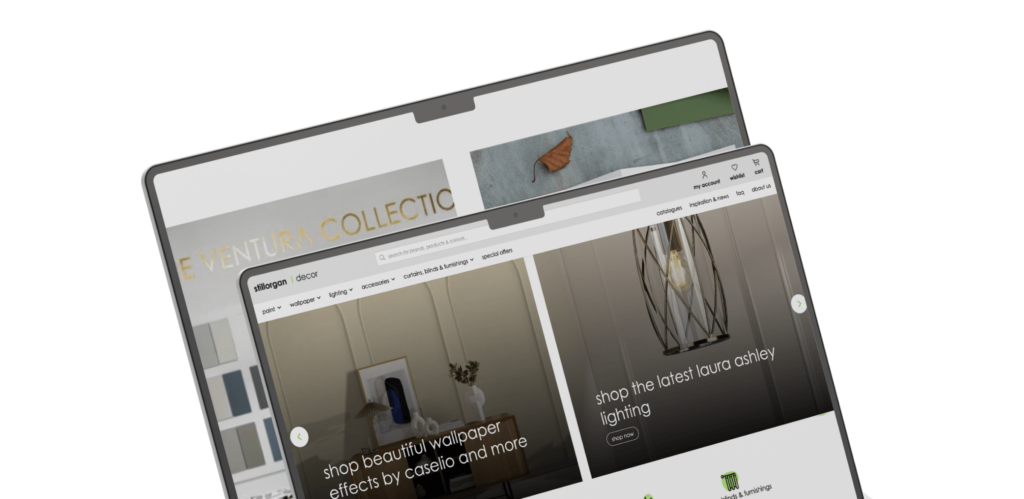

Stillorgan Decor Centre Limited, established in 1978 in Dublin, operates a large-scale e-commerce website with over 5,000 pages, specialising in home decor and DIY products. The company’s digital growth strategy has focused on technical SEO, content optimisation, and competitive benchmarking, particularly adapting to the evolving search landscape in 2024–2025 with the irruption of AI-generated content in a highly competitive niche.

Stillorgan Decor leads in traffic and keyword rankings, with a strong presence in high-conversion product categories.

Stillorgan Decor’s SEO strategy is highly effective. Through a disciplined focus on technical health, backlink quality, and competitor tracking, it delivers industry-leading growth in traffic, visibility, and keyword rankings. The approach is resilient to market and algorithmic disruptions and positions the brand for continued leadership in its niche. Addressing CTR, improving authority, and expanding internationally are logical next steps to build on this strong foundation.

An impactful digital campaign that captures the essence of Scandinavian comfort and craftsmanship, elevating Furninova’s presence in the Maltese market.

Levelling up Searchability for Real Adventures Connemara through SEO